Request your free consultation below:

Prices starting as low as $100.00 for individual tax preparation. Please request a free consultation.

Individual Federal Income Tax Services

- Tax Return Preparation & Filing

Accurate preparation and electronic filing of federal tax returns for individuals. - Tax Planning & Strategy

Year-round planning to minimize tax liability and maximize deductions and credits. - IRS Notice & Audit Assistance

Guidance and representation in responding to IRS letters, notices, or audits. - Amended Tax Returns (Form 1040-X)

Correction and resubmission of previously filed returns to fix errors or claim missed deductions. - Estimated Tax Payment Planning

Calculation and scheduling of quarterly estimated payments to avoid penalties. - Retirement & Investment Tax Planning

Tax-efficient strategies for 401(k)s, IRAs, capital gains, and dividends. - Education & Child Tax Credits

Maximizing benefits from the American Opportunity Credit, Lifetime Learning Credit, and Child Tax Credit. - Multi-State & Residency Tax Filing

Support for taxpayers with income from multiple states or relocation during the year. - Self-Employed & Freelancer Tax Support

Guidance on deductions, quarterly payments, and business expense tracking for independent contractors.

Small Business Federal Income Tax Services

- Business Tax Return Preparation (Form 1120, 1120-S, 1065)

Comprehensive preparation and filing for corporations, S-corps, and partnerships. - Sole Proprietor & Schedule C Filings

Detailed reporting for self-employed business owners. - Tax Planning for Small Businesses

Strategic planning to reduce tax burden and improve cash flow. - Entity Selection & Tax Structure Consultation

Guidance on choosing the best business entity (LLC, S-Corp, C-Corp, Partnership) for tax efficiency. - Bookkeeping Integration for Tax Reporting

Review and alignment of bookkeeping records with tax filing requirements. - Depreciation & Asset Management

Proper classification and depreciation of business assets for maximum tax benefit. - Estimated Quarterly Tax Payments

Calculation and filing assistance to stay compliant throughout the year. - IRS Representation & Compliance Support

Expert help with IRS correspondence, audits, and payment plans. - Year-End Tax Planning & Review

Proactive tax strategy before year-end to identify savings opportunities. - Payroll & Employment Tax Compliance

Support for payroll tax filings and federal employment tax requirements (Forms 941, 940, W-2, 1099).\

Frequently Asked Questions (FAQ)

1. What documents do I need for federal income tax preparation?

For individual federal income tax services, you’ll need your W-2s, 1099s, mortgage interest statements, and documentation for deductions or credits (such as education or childcare expenses).

For small business tax preparation, please bring income and expense reports, bank statements, and payroll records. We’ll provide a checklist to make sure you have everything you need.

2. When is the best time to start preparing my taxes?

We recommend starting early—ideally in January or February. Beginning your tax preparation early helps you avoid last-minute stress, ensures accuracy, and allows you to receive your refund faster.

3. Do you offer electronic filing (e-file) for tax returns?

Yes. We use secure, IRS-approved e-filing services for both individuals and small businesses. E-filing ensures fast processing, and most clients receive refunds within 2–3 weeks.

4. What should I do if I receive a notice from the IRS?

If you receive a letter or notice from the IRS, contact us immediately. We provide IRS help and representation, reviewing your notice and guiding you through your response to resolve any issues quickly and professionally.

5. Do you offer services for self-employed individuals or freelancers?

Absolutely! We specialize in self-employment tax preparation, helping freelancers, contractors, and gig workers track deductions, file Schedule C forms, and manage quarterly estimated payments.

6. What’s the difference between tax preparation and tax planning?

Tax preparation focuses on filing your return accurately for the current year.

Tax planning is a proactive service that helps you reduce your tax liability through smart financial strategies, deductions, and credits. We offer year-round tax planning services for both individuals and small businesses.

7. Can you help with unfiled or back taxes?

Yes. Our IRS compliance services assist with filing past-due returns, setting up payment plans, and resolving back-tax issues. We’ll help you get back on track and avoid future penalties.

8. How much do your tax services cost?

Pricing depends on the complexity of your tax return. After a brief consultation, we’ll provide transparent, upfront pricing for your individual or small business federal income tax preparation—no hidden fees.

9. Can I file my taxes remotely?

Yes! We offer virtual tax preparation and planning services. You can securely upload your documents, meet with us online, and e-sign your forms from anywhere.

10. Do you offer year-round tax support?

Yes. Unlike seasonal tax preparers, we’re available year-round to assist with tax planning, IRS notices, and business growth strategies so you can stay prepared for every tax season.

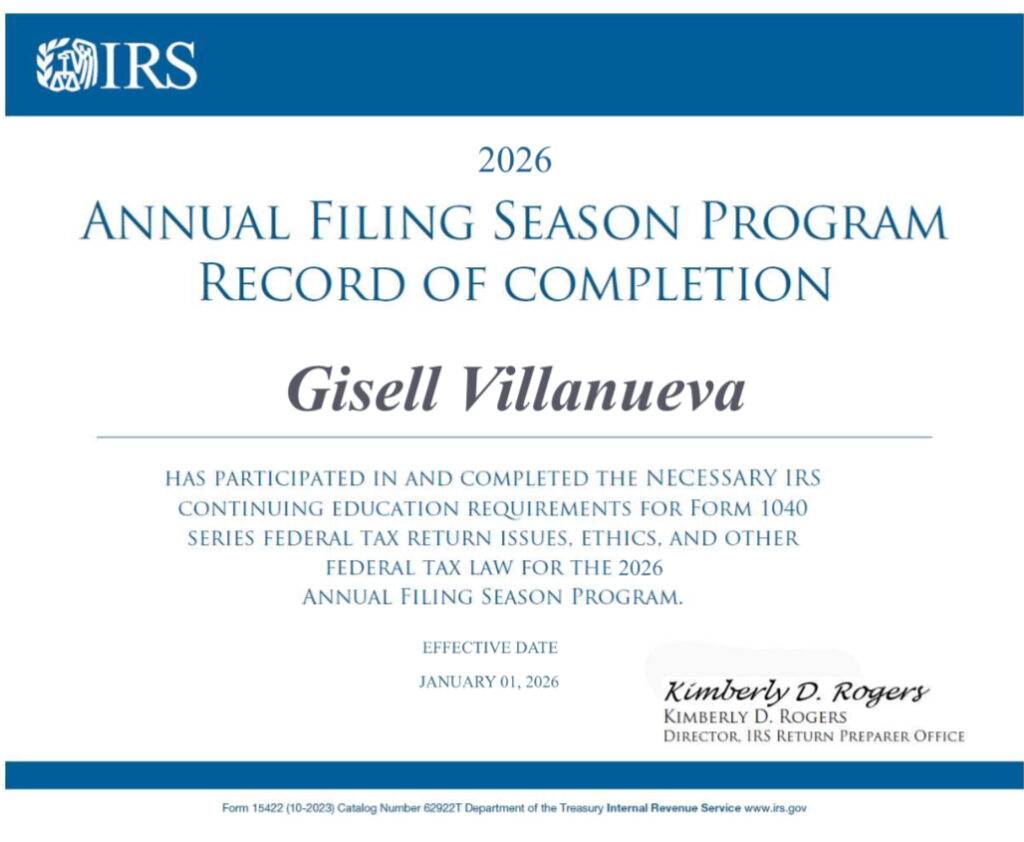

11. Why choose Villanueva Solutions for your federal income tax needs?

We combine expert knowledge with personal attention. Our team understands IRS regulations, small business tax laws, and individual tax strategies, helping you maximize savings, minimize stress, and stay compliant all year long.